Faculty leaders will push the Board of Trustees to add at least $1 million to the University’s budget to cover more employee health care costs after two years of skyrocketing out-of-pocket payments.

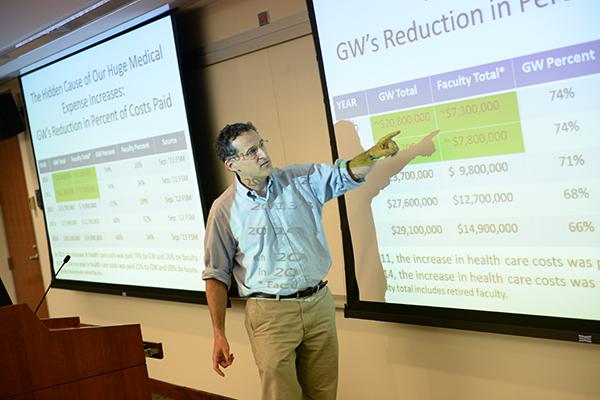

The Faculty Senate blasted administrators for cutting about 10 percent in funding for the University’s health care benefits over the last four years. Meanwhile, health care costs for employees rose nearly 25 percent since 2012.

The resolution that passed at Friday’s Faculty Senate meeting called for the University to take on a larger portion of employees’ out-of-pocket payments without cutting other benefits. The Board of Trustees, the University’s highest governing body, will vote on GW’s health insurance plan this week when it reviews next year’s operating budget.

The rare backlash against administrative policies comes after about 100 professors banded together last month to create the Faculty Association, which is lobbying administrators for a less expensive plan.

Murli Gupta, a professor of mathematics and the chair of the committee on appointment, salary and promotion policies, said in an interview that a $1 million increase would put GW back in line with past plans that covered about 75 percent of total health care costs.

The amount is fair because it is “not very much” of the University’s about $1 billion operating budget, Gupta, who introduced the resolution, said.

Benjamin Hopkins, a professor of international affairs and a member of the Faculty Association’s steering committee, said GW now covers just 66 percent of an employee’s health care needs.

“We’d like GW to return back to the historical norm,” he said.

Health care costs have skyrocketed in part because claims have risen by double digits for the past two years. This year’s 12.5 percent cost increase helped cover the $6.5 million the University had to pay last year for expensive procedures.

In 2013, health care costs made up about 45 percent of the $98.5 million that GW spent on all employee benefits for the year.

With the rollout of the Affordable Care Act, medical costs have also increased nationwide, though GW’s costs have grown quicker than those of its peers. Universities across the country saw the average employee premium increase 3.25 percent for employee-only plans and 5 percent for family coverage plans, according to a survey conducted by the College and University Professional Association for Human Resources last year.

About two-thirds of GW’s employees are on the University’s health care plan, with about 2,700 additional dependents, like spouses and children, also signed up for the health insurance. About 250 more faculty and staff have joined GW’s health care plan to avoid facing fines under the Affordable Care Act.

Vice President for Human Resources Sabrina Ellis said costs increased partly because of more chronic disease cases and new, but expensive, medical technologies. She told Faculty Senate members that GW’s three plan options allow employees to have greater flexibility than other institutions.

“We use the money we do get in the best way possible,” Ellis said. “There are many steps these other institutions have taken to control cost that GW is looking at taking, and we have started to take some of those steps, but there are still additional steps that we will need to look at.”

Her office will review the benefits package plans this summer and report back to the Faculty Senate in September, she said in an email.

As GW has cut health care-related funding, faculty have also received fewer raises or pay incentives, said Tyler Anbinder, a history professor and member of the newly formed Faculty Association.

Anbinder pointed to the rates at American and Boston universities, which show that GW faculty pay more out-of-pocket costs for family health plans. At both institutions, the university paid more of the total premium than at GW.

“We’re just trying to shed some light on where the GW faculty health care benefits are and try to get them closer to where they once were,” Anbinder said in an interview.

GW’s coverage is below normal, he added, arguing that the average U.S. employer pays 72 percent of a family preferred provider organization plan.

This year’s premium hikes increased 43 percent in co-payments for specialist visits. Faculty also saw an increase in out-of-pocket payments for hospital visits under all three plans offered.

Eric Arnesen, a professor of history and new member of the Faculty Senate, said professors also need to push administrators to make the decision-making process more transparent.

Arnesen is one of the more than 160 employees who signed a petition this winter to protest the increasing health insurance costs.

“We’re skeptical of this information. We have to look very closely at what your office and others are saying,” he said at the meeting.