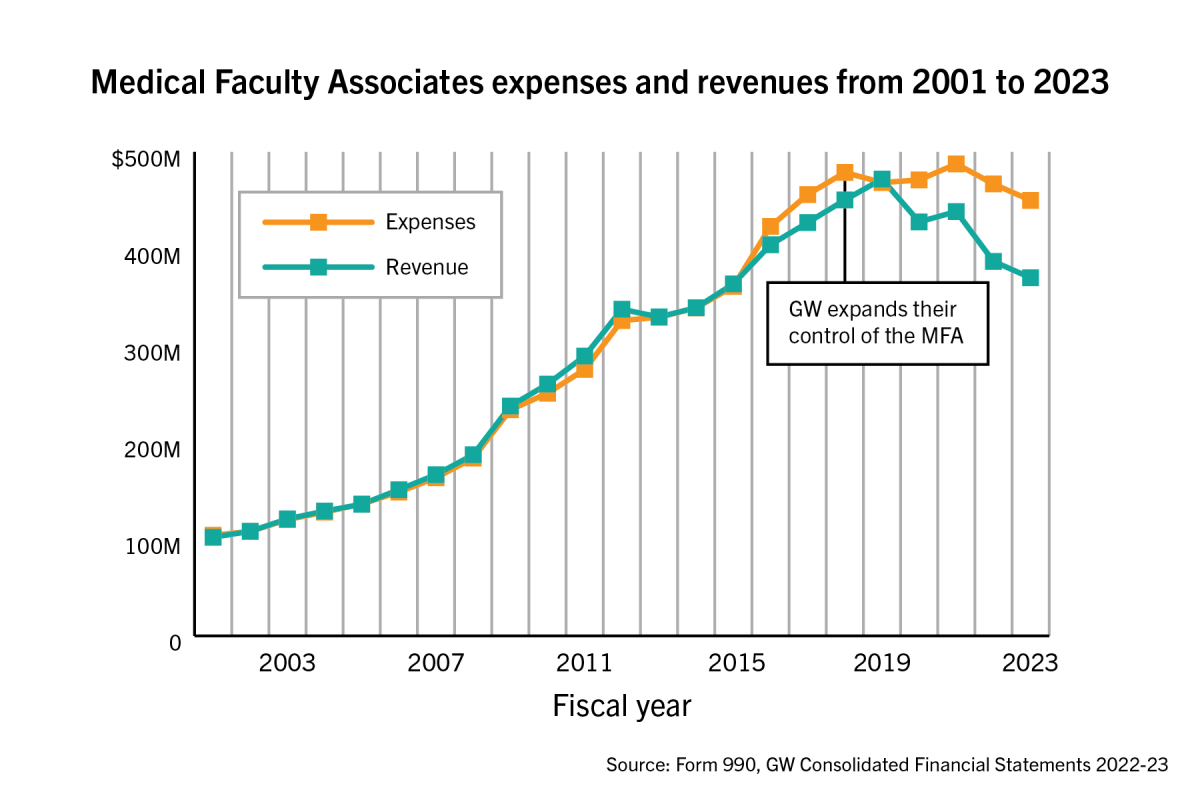

The Medical Faculty Associates used to be financially stable.

The nonprofit group of doctors, nurses and health care staff used to break even — and sometimes exceed expenses by millions — while providing primary care to District-area residents and medical education to students at GW’s School of Medicine and Health Sciences. Then, GW took the reins in 2018.

GW gained more governing power, including the authority to approve the MFA’s CEO, manage the annual budget, amend the organization’s bylaws and appoint members to the MFA’s Board of Trustees. But during the University’s first full year heading the MFA in fiscal year 2020, the organization lost more than $43 million. The next year, the MFA lost $49 million.

Officials blamed initial losses on the outbreak of the COVID-19 pandemic, but the MFA has failed to recover since then, now floundering to close to a $250 million deficit since FY 2020.

Two years in a row, officials have projected the MFA would break even on the year, only to retract those projections just months later. Now, CFO Bruno Fernandes said he expects the MFA to lose between $30 million to $50 million in FY 2024.

GW, responsible for the MFA since December 2018, has paid for these losses out of pocket, granting loans to the MFA that now total close to $200 million. Fernandes said the MFA has so far made all necessary payments on their debt at an October Faculty Senate meeting.

But as the years have gone by and the MFA’s debt continues to pile up, faculty have sounded alarms about how GW’s copious loans to the MFA might stifle other University operations.

The Faculty Senate passed a resolution Friday urging the Board to evaluate the MFA’s debt and its potential effect on GW’s “underfunded areas,” like student financial aid and undergraduate education. The resolution marks the second time senators have called on officials to improve communication surrounding the MFA’s finances. Officials began giving quarterly updates to the Faculty Senate on the MFA’s finances this fiscal year after senators passed a resolution in January 2023 asking for updates to a pair of senate committees; updates came annually before then.

Fernandes said the MFA’s agreement with Universal Health Services — which owns GW Hospital — prohibits the University or the MFA from sharing details of the model or arrangement publicly. He said the MFA’s finances reflect issues other physician practices also face.

“Urban clinical and medical practices have been encountering challenges over the course of the past few years,” Fernandes said in an email. “These challenges are not unique to the MFA; rather, several urban medical practices have faced financial roadblocks.”

Officials said in an email that the MFA has had “no impact” on GW’s endowment.

At this point, they should be profitable.

— Former MFA CFO Steve MacDonald

“I genuinely mean that as someone who doesn’t really understand some of the sophisticated discussions that are taking place right now, but what does it mean to have $80 million carried over as losses and at what point does the University say this is no longer good for the University?” Sarah Wagner, a faculty senator and a professor of anthropology, said at an October senate meeting in response to a presentation on the MFA’s losses in FY 2023.

MFA CEO and SMHS Dean Barbara Bass said at Friday’s senate meeting that the MFA’s finances went “off the tracks” during the pandemic but officials now have the chance to resurrect the organization’s financial viability. GW’s medical enterprise does pay for the money it has borrowed each year, which contributes to the University’s spendable revenue, she said.

Bass did not return a request for comment.

“I recognize the perception that this in some way undermines the University,” Bass said at the meeting. “I really regret that.”

She said new “expertise” in MFA leadership will make “tough moves” by the end of the fiscal year to turn around the organization’s losses. The MFA welcomed new CFO Robin Nichols in September.

“Nobody is fooling themselves about the challenges that we have faced,” Bass said.

Post-pandemic losses

Former MFA officials who worked for the organization before GW’s takeover said the group’s bleak financial forecast reflects the MFA’s incorporation’s business model and leadership.

Steve MacDonald, the MFA’s CFO from January 2017 to May 2019, said following GW’s acquisition, the University “eliminated” the MFA’s executive management team, beginning with his position as CFO followed by the chief of human resources and the chief legal, business strategy, technology and executive officers. He said GW officials assumed the roles of the executive management team or chose other people to fill them.

MacDonald alleged GW’s financing for the MFA comes from their endowment — a financial foundation used to fund professorships, scholarships and construction projects largely from donations. He said it’s up to GW’s Board to determine how much money they’re willing to lend to the MFA and for how long so that the MFA doesn’t have to file for bankruptcy.

MacDonald said GW’s loans to the MFA are a “stopgap” for when the MFA needs more cash flow than what a bank can provide.

“If you look at other academic medical practices around the country, those that have had sustained losses, largely, many have filed for bankruptcy,” MacDonald told The Hatchet. “So whether or not GW decides to ultimately go down that road with the MFA is up to them. They can either fund those losses or at some point, it’s unsustainable for the banks to be involved.”

Faculty senators have said that the University is held liable for decisions the MFA makes, meaning GW would have to pay the MFA’s borrowed debts if it were to file for bankruptcy.

MacDonald said the pandemic likely played a role in the company’s deficits, but the losses now speak more to how the executive management conducts their business.

“I’m sure COVID had an impact, I won’t discount that. Everyone had challenging times during COVID,” MacDonald said. “However, at this point, they should be profitable. We’re no longer in that stage. They should be coming out of that. So I think now it’s more reflective of the management and in how they run the business.”

Debt recovery efforts

Stephen Badger, the former CEO of the MFA from 1999 to 2015, said he was hired as the first nonphysician CEO to lead the organization because, at the time, officials wanted a business leader to help the group recover from $9.5 million in losses. He said the MFA was “profitable” after the first three years of his tenure because he provided salary increases for the physicians, which incentivized them to stay and increase revenue from patients.

The MFA had about a $2 million deficit in FY 2001 but was able to recover to a $86,000 profit in FY 2002. The MFA remained profitable until 2015.

“We took them off that line of credit after three years and we no longer needed that financial security or support because we were profitable, and we had a good plan in place and we were growing,” he said.

Badger said University officials “cut the head off” the MFA leadership when they terminated the MFA’s leaders and thought they could manage the enterprise themselves, which led to their financial demise. He said the MFA needs a strong business leader to achieve profitability.

“It was a terrible financial decision,” Badger said.

The MFA faced deficits in 2015 and 2016, which MacDonald said was caused by the failed implementation of Epic, a medical record software system. MacDonald said the MFA fired the former CEO, Badger, and brought in Robert Kelly as CEO and himself as CFO, and the pair ultimately brought the organization back into a profit in FY 2019.

The University first lent money to the MFA in 2016 with a $20 million loan, after the MFA spent $61 million more than its revenue in FY 2015. Officials forgave that $20 million line of credit in 2019, which former GW CFO Mark Diaz said at the time was to increase the MFA’s stability and to help the group through its fiscal turbulence.

MacDonald said the new executive management team brought the MFA back to profitability by negotiating with the District to help cover the cost of the MFA’s Medicaid patients, negotiating service contracts for MFA doctors who staffed the GW Hospital and instituting a budget process that held MFA staff accountable to their budgets. He said current MFA officials should replicate his approach to return to profit.

“As the MFA continues to recover from financial challenges brought on by the pandemic, the MFA has built a team of leaders who are establishing a pathway forward that will support the missions of our organization,” MFA spokesperson Anne Banner said in a November email.

Faculty demand answers

Professors for at least three years have asked for increased transparency about the debt-recovery efforts for the MFA and worry that the University’s loans to the debt-riddled organization take away opportunities for the money to fund GW’s schools and colleges.

Eric Grynaviski, an associate professor of political science and international affairs and a former faculty senator, said in an October 2022 senate meeting that officials haven’t said whether they will cap the amount of money they allow the MFA to borrow without repercussions.

“I don’t see a red line,” Grynaviski said. “I don’t see a plan for what they’re doing with the money. I just see us covering either inefficiencies or doctor salaries, and I just don’t get it.”

Anthony Yezer, a professor of economics and a former faculty senator, said in a May 2022 senate meeting in response to a report on the MFA’s operations that the group’s finances were concerning from a business perspective.

And Wagner, the faculty senator who introduced the resolution asking trustees to evaluate the MFA’s debt and its potential effect on GW operations, said at the time that the request is not an “attack” on the medical enterprise.

“It’s born from a concern for the well-being and success of the entire University,” Wagner said.

Updated: Feb. 28, 2024, at 1:08 p.m.

This post was updated to reflect the following:

Due to an editing error, The Hatchet incorrectly reported that the University did not return a request for comment on the MFA’s impacts on the University’s endowment. Officials said it had no impact. We regret this error. This post was also updated to include context about the University’s loans to the MFA in 2016.