Officials will increase employee contributions to medical, dental and vision coverage in January, according to an annual employee benefits report released earlier this month.

The report states the University will raise employee medical coverage contributions by a “nominal” 1.3 percent, while dental and vision coverage contributions will increase by 1.4 percent and 1.5 percent, respectively. Experts in academic human resources said the rise in contributions – percentages taken from employees’ salaries to fund health care services – is similar to increases at other universities and are minimal considering the impact of inflation on the cost of services.

Officials increased medical coverage contributions by 1 percent but decreased dental coverage contributions by 1.5 percent in last year’s updates.

University spokesperson Kathleen Fackelmann said the increases to medical, dental and vision coverage contributions are based on the annual increase in the cost of health care services and GW employees’ “overall utilization” of the health care services the University offers.

“Each year, GW works with its vendor partners to review utilization of health and welfare benefits programs with the goal of providing the most comprehensive benefits offerings, at the most reasonable costs,” Fackelmann said in an email. “The GW benefits package is designed to attract and retain faculty and staff and support the health and well-being goals for participants.”

The report states that 80 percent of full-time participants in the University’s medical plan will see an average increase of less than $5 per month in their medical contributions, which is in line with the 90 percent who experienced the same average monthly increases in their contributions last year.

Monthly increases will range from less than $1 to about $11 for employee medical contributions, according to an employee’s plan, salary band and coverage level, the report states. Increases to employee medical contributions ranged from $1 to $8 last year.

Monthly employee dental contributions will increase by less than $2, and monthly employee vision contributions will increase by less than $1 for all plans and coverage tiers, according to the report.

Officials will launch a new enrollment system for employee insurance benefits in January. The new system, which has “single sign-on capability” that now allows employees to sign in to the system automatically if they are already logged into their GW account on their GW computer, will operate through bswift, an online benefits enrollment and administration system.

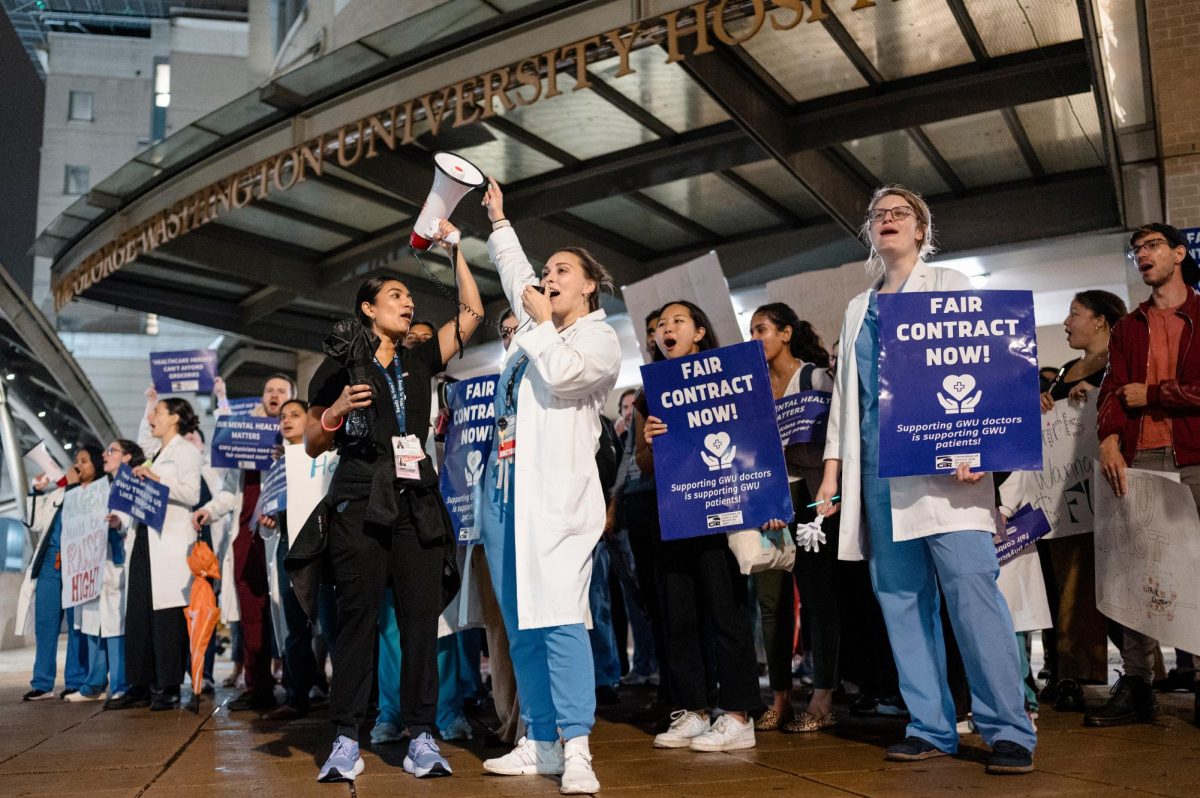

Experts in academic human resources said higher education institutions, like GW, must ensure that employees are able to afford the increases in their contributions and should prioritize benefits to improve mental health and well-being.

Robert Roop, a professor and the chief human resource officer at Webster University, said a minute growth in employee contributions to insurance benefits are in line with increases at other universities.

“No one likes their benefit-cost increase, let’s accept facts,” Roop said. “But a 1.5 to 2 percent increase in this market is really excellent and should be well received.”

Roop, a member of Webster University’s Panel of Experts on Human Resources, said higher education institutions may seek to improve their employee benefits by lowering employee contributions to outperform peer institutions, like Georgetown and New York Universities.

He said decreases in employee contributions must reflect the institution’s ability to pay for those benefits and increases must reflect employees’ ability to pay.

“It’s called cost sharing, and you can only pass the increase back to the employees to a percentage that they can afford,” Roop said. “So the improvement really comes back to cost management.”

Roop said employee welfare beyond medical insurance is becoming a serious concern, and higher education institutions like GW must prioritize benefits that improve employee wellbeing to secure the health and happiness of their employees.

“The idea of employee well-being is becoming a very, very leading issue in benefit discussions,” Roop said. “So as they try to improve, they should focus more globally on the total benefit, not just the medical.”

Fred Foulkes, the director of the Human Resources Policy Institute at Boston University, said the increases in employee contributions are “reasonable” given the impact inflation has had on healthcare costs.

The annual U.S. national health expenditure by 2027 is likely to be $370 billion higher than projections of annual expenditures made prior to the COVID-19 pandemic because of the impact of inflation, according to an estimate from McKinsey & Company – a global management consulting firm.

“The costs are going up because of inflation, and then if you look at what’s happened to salaries of nurses and a lot of new drugs, which are very expensive,” he said. “It’s easy to understand why the cost is going up, so I guess the question is how should they be shared between the employer and the employee?”

Foulkes said it is increasingly necessary for employee health care benefits to include resources for mental health because of the impact the COVID-19 pandemic had on people’s mental well-being.

The Chronicle of Higher Education reported that a majority of surveyed higher education faculty members in October 2020 experienced increased levels of “frustration, anxiety and stress” due to the impact of the pandemic.

The report states that the University offers employees who are eligible for the benefits and members of their households five free counseling sessions through the GW Employee Assistance Program – a program that assists GW employees with work-life balance concerns, like dealing with mental health issues.

Employees who are eligible for the University’s benefits and their dependents, who are 13 years or older, can also receive five weeks of free chat therapy through Talkspace, a text therapy app, according to the report.

“There’s the big need to have good benefits with respect to mental health,” Foulkes said. “That’s really become much more significant during COVID.”