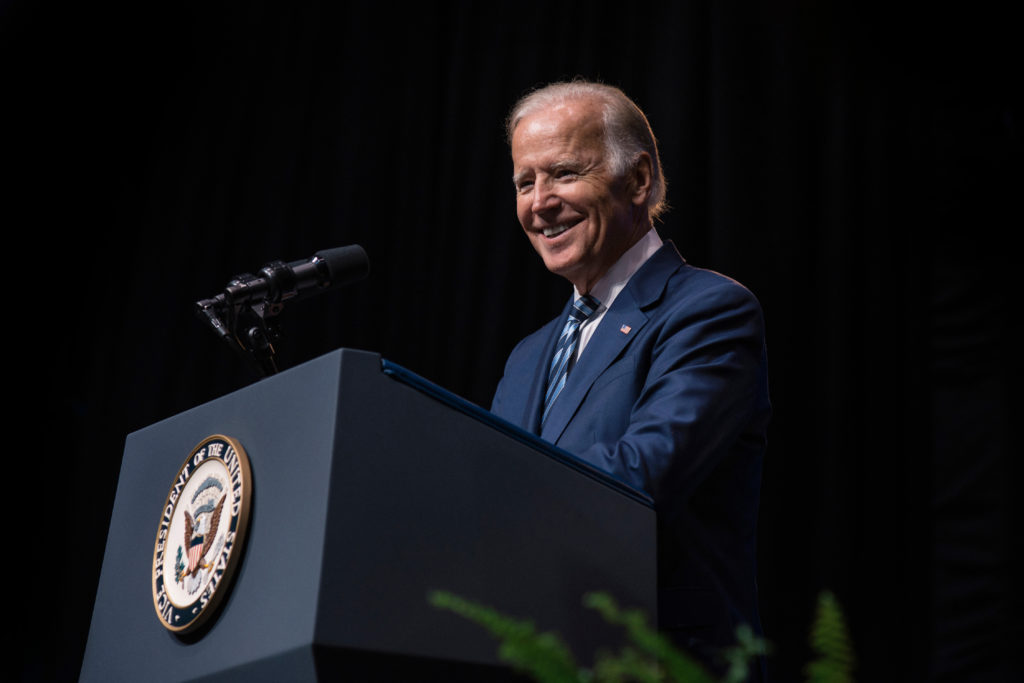

Higher education experts said President Joe Biden’s plans to forgive up to $10,000 of debt may not benefit GW graduates who have taken out larger loans.

In an email to The Hatchet, an Education Department spokesperson said Biden and Education Secretary Miguel Cardona are “taking a close look” at all options regarding student loans. But the spokesperson said any action taken on student loan cancellation must be in the form of congressional action and not through executive action by Biden or Cardona.

“It is crucial any discussion of student loan cancellation must come with congressional action to address affordability going forward,” the spokesperson said in the email.

Cardona, who worked as an elementary school teacher before becoming Connecticut’s education commissioner, has spent the beginning of his tenure primarily focused on reopening K-12 schools after COVID-19 shutdowns. Cardona, who was confirmed by the U.S. Senate earlier this month, will also work on Biden’s plan for higher education policy, which includes a proposal to offer tuition-free public university education for families making less than $125,000 and free community college.

“For far too long, we’ve let college become inaccessible to too many Americans for reasons that have nothing to do with their aptitude or their aspirations and everything to do with cost burdens and, unfortunately, an internalized culture of low expectations,” Cardona said in a speech following his nomination in December.

The Senate confirmed Cardona as secretary of education in a bipartisan vote of 64 to 33.

During the presidential transition period, Biden called on Congress to cancel $10,000 in student debt per borrower. Prominent Democrats have called on Biden to cancel student debt by executive order, but experts have warned that Biden could run into legal challenges if he attempts to achieve the goal without Congress.

Former Education Secretary Betsy DeVos was a staunch opponent of student loan forgiveness, denying nearly 130,000 claims for forgiveness in her last year in the position alone.

Stephanie Cellini, a professor of public policy and public administration at the Trachtenberg School of Public Policy and Administration, said Biden’s plan to cancel $10,000 of student debt would go a “long way” in helping student borrowers who could potentially fail to pay their loans.

“The $10,000 plan seems to focus in on the students who are most likely to default on their loans,” she said. “It’s kind of counterintuitive, but most of the students who end up defaulting on their loans are students who borrow $10,000 and less.”

She said that relief needs to be targeted to ensure financially vulnerable borrowers, like students who drop out of school, don’t default on their loans.

“I worry a lot about low-balance borrowers who may default, and these tend to be students who drop out of college after taking just a few classes or they tend to be students at for-profit institutions,” Cellini said.

She said students from higher-level universities like GW may not necessarily be the targets of debt relief, as they are more likely to be able to pay off their loans.

“Students who get a B.A. from places like GW and other high-quality colleges see their earnings go up and, for the most part, they are able to repay their debt,” she said. “If we’re thinking about four-year college and more expensive colleges, like GW, college still pays off.”

Biden has also considered working to expand a specific category of loan payment plans called “income-driven repayment plans.” These plans allow borrowers to pay different amounts of their loan back depending on their income level and then have their balance forgiven after a certain amount of time, usually 20 years.

Cellini said income caps, which limit who qualifies for debt forgiveness to those earning under a certain income level, could help target relief to those who need it most.

“Those are a good idea to have some kind of a means-test there so that people who are doctors or lawyers and are going to be able to repay because they have high earnings don’t necessarily need their loans forgiven,” she said. “We want to make sure we’re targeting the relief to people who most need it.”

Constantine Yannelis, an assistant professor of economics at the University of Chicago, said the severity of students’ financial situations depends on the borrower. He said medical students, who borrow relatively more money but earn higher incomes to pay off loans later, fare better than graduates of for-profit colleges and community colleges, who he said face “adverse outcomes.”

“Many borrowers, but not all, are struggling and would benefit from debt relief,” Yannelis said.

He said the majority of the benefits of debt forgiveness would center around high-income individuals, who tend to have a more expensive education than those with lower incomes. Yannelis said an expansion of income-driven repayment plans would be beneficial in targeting relief to those in need.

“Expanding the usage and generosity of income-driven repayment plans would lead to more benefits for low-income borrowers,” he said. “Expanding these plans would target relief to those who really need it and who are facing financial difficulties.”