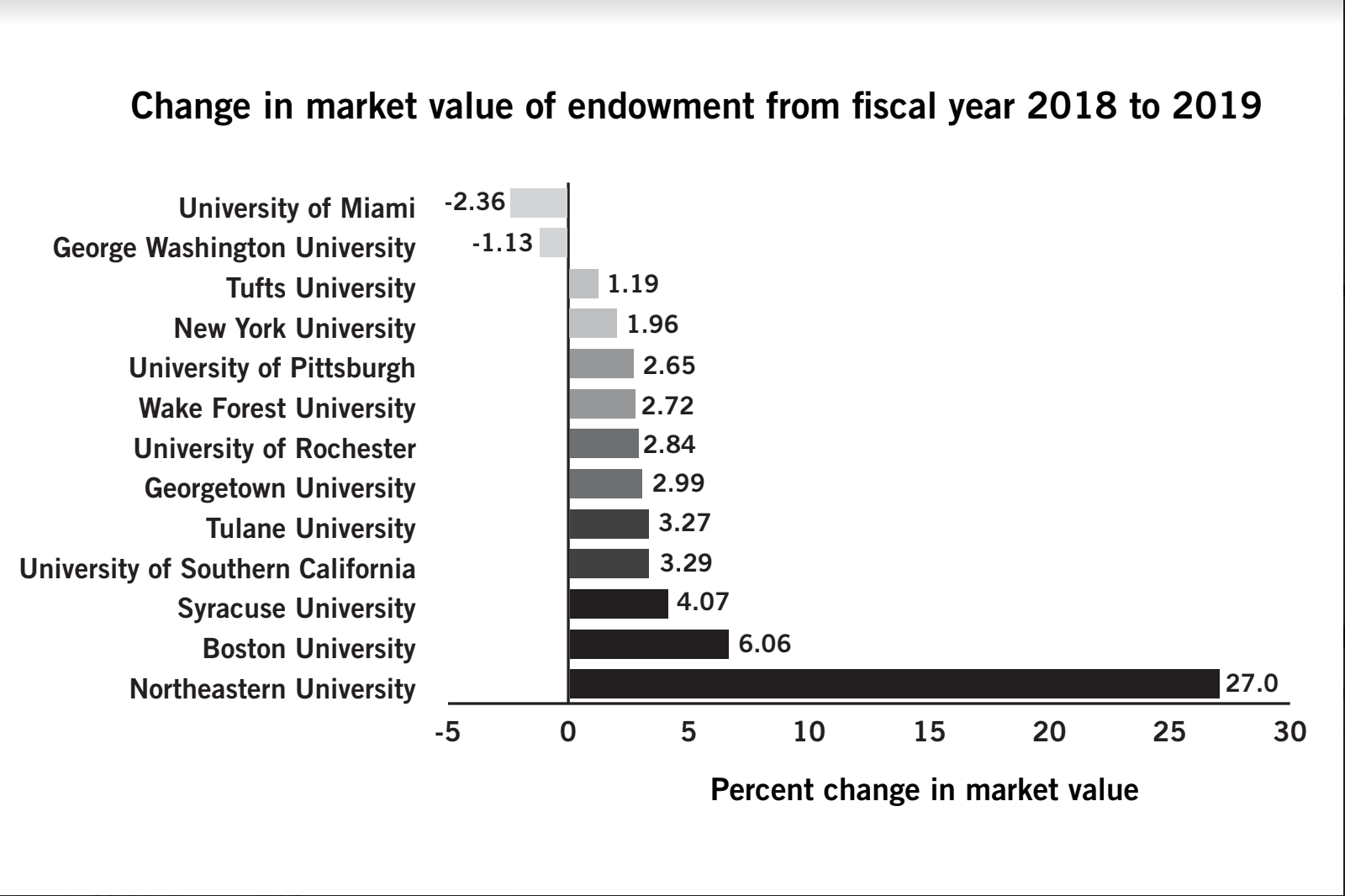

GW’s endowment shrunk in value during fiscal year 2019 while all but one of its peers’ endowments grew.

Only two schools among the University and its peers – GW itself and the University of Miami, University President Thomas LeBlanc’s former institution – faced negative growth in the market value of its endowment, according to a report released last month. GW’s endowment decreased in value by 1.13 percent in fiscal year 2019 – from about $1.80 billion to about $1.78 billion – according to the report, which officials have said is the result of natural variation in returns on investments.

The National Association of College and University Business Officers and the Teachers Insurance and Annuity Association of America released the report, which details the endowments of 774 U.S. colleges and universities and found that university endowments grew by 5.3 percent on average in fiscal year 2019.

Alyssa Ilaria | Graphics Editor

“Endowments continue to play a significant role in institutions’ operations and financial strength, making it essential to take advantage of a wide range of investment options and strategies,” Kevin O’Leary, the chief executive officer of TIAA Endowment and Philanthropic Services, said in a release. “Endowment asset allocations and returns varied across different size endowment cohorts.”

Eleven of GW’s 12 peer institutions experienced positive endowment growth during the fiscal year, while Miami’s endowment shrunk by about 2.36 percent – double the rate of GW’s decline. Northeastern University’s endowment grew the fastest, at 27 percent over fiscal year 2019.

In fiscal year 2018, the University’s endowment grew by 4 percent, the slowest among its peers.

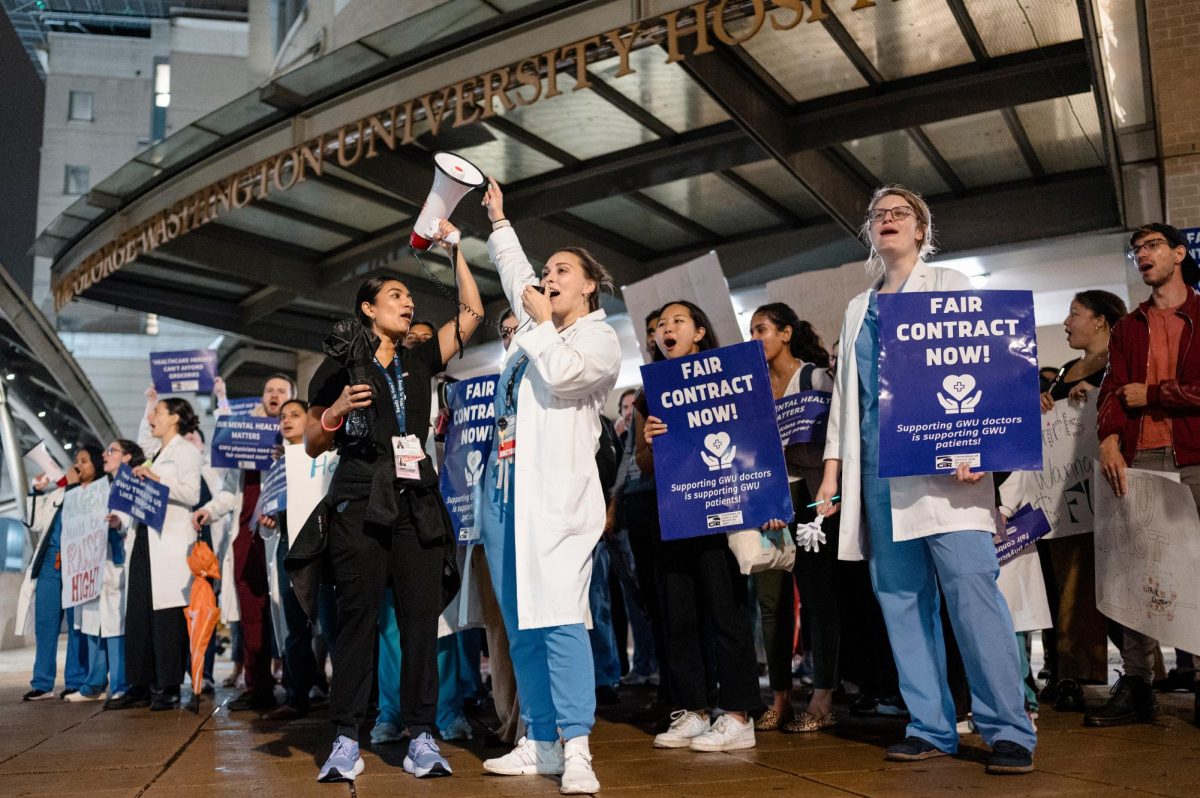

The sluggish endowment growth comes after students concerned with climate change organized several protests calling on LeBlanc to divest GW’s endowment from fossil fuel companies. LeBlanc revealed last month that about 3 percent of the endowment is invested in fossil fuels.

Higher education and economics experts said the reduction in the endowment’s value can place a restraint on the University’s ability to pay for additional resources and increase the possibility of budget cuts.

Ronald Ehrenberg, a professor of industrial and labor relations and economics at Cornell University, said below-average endowment growth relative to peer schools could indicate poor investment performance.

“A decrease in endowment may indicate that they were spending too much out of the endowment and that it would be prudent for them to spend less,” he said. “It could also simply indicate that they failed to get any substantial gifts to build the endowment.”

Rick Seltzer, a project editor for news outlet Inside Higher Ed, said administrators rely on the funds generated by an institution’s endowment to supplement spending needs. He added that a drop in the endowment value is normal from time to time but deserves scrutiny if the negative growth makes the institution an outlier relative to peers.

“In a year like last year, when most posted growth, I think it’s fair to look at any institution losing endowment market value and ask what happened,” he said in an email. “The answer to this question could be extremely varied. One investment in particular could have lost a lot of value, there could have been some sort of extraordinary draw for a project that will be paid back over time or accounting for a certain gift may have changed.”

Seltzer added that the degree to which endowment decreases could affect the student body depends on the duration and size of the decrease.

“Colleges and universities generally don’t set spending rates based on one year’s change, so a single year of losses probably won’t be felt directly by students currently on campus,” he said. “But if you have losses year after year, it’s possible institutions will lower their spending rates.”

Mark Stater, an associate professor of economics at Trinity College, said a shrinking endowment could necessitate budget cuts.

Former University President Steven Knapp instituted a budget cut of 3 to 5 percent across all administrative units over five years, starting with the 2017 budget year following a drop in graduate student enrollment.

“The higher the endowment, the more funds are available for the institution to spend,” Stater said in an email. “So the administration can either balance the budget more easily or use the additional funds for spending on academic or athletic programs and campus infrastructure.”

He said administrators can counteract smaller or negative returns to an endowment’s value through fundraising campaigns and investments. GW’s alumni giving rate has clocked in as the lowest of its 12 peer schools for two consecutive years, but the University experienced its third highest fundraising year in fiscal year 2019.

“Universities can build up endowment through fundraising, conducting capital campaigns, working with their fund managers to adopt a higher-return investment strategy, which also probably entails higher risk, or simply trusting the existing investment strategy and waiting,” he said. “Endowments, like most investments, tend to go up over time as long as not too much is taken out and the market doesn’t take a downturn.”