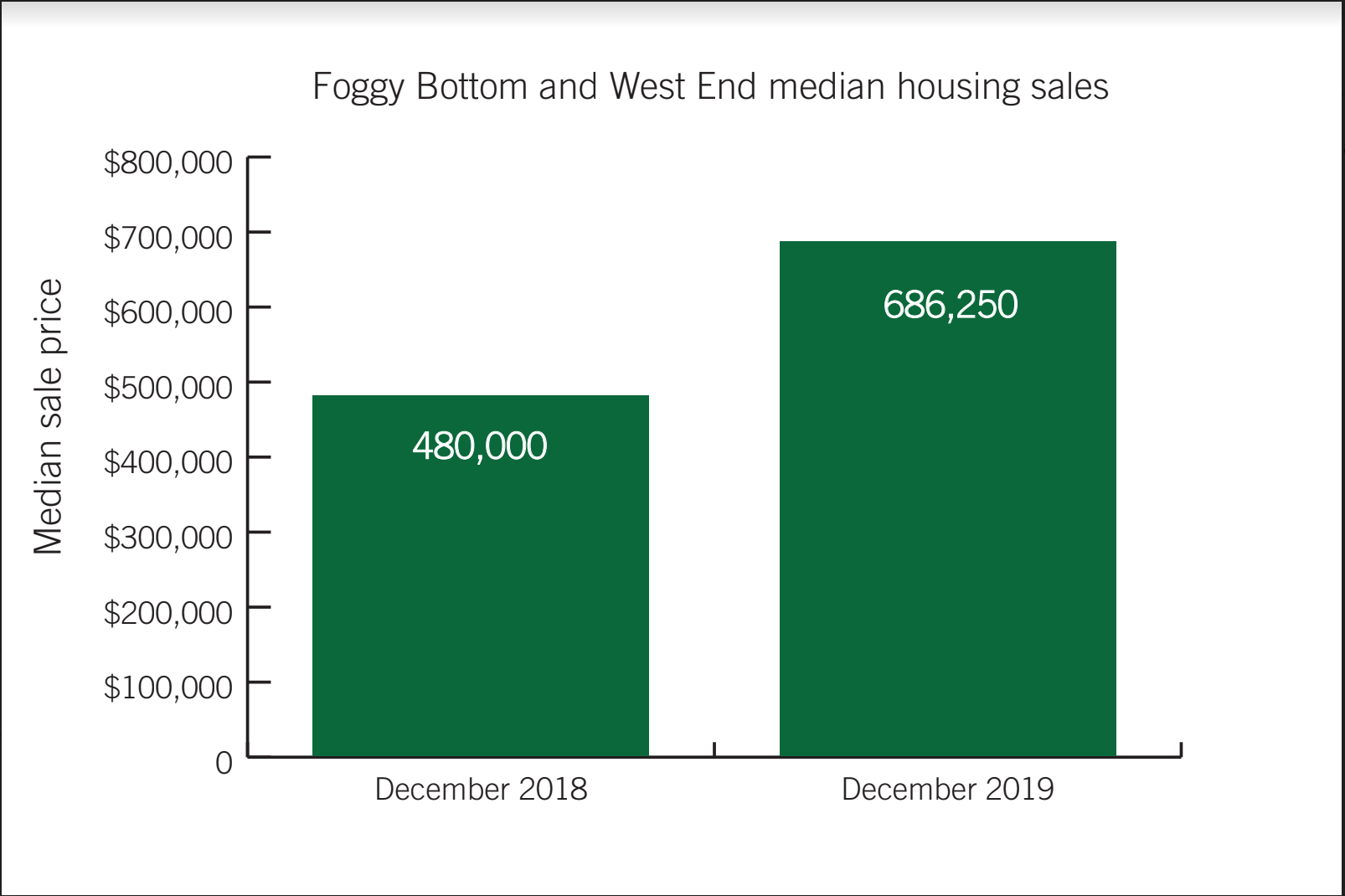

The price of houses sold near campus increased by nearly 43 percent in 2019, according to real estate company Long and Foster’s end-of-year report.

The median sale price of a single-family home in the Foggy Bottom and West End neighborhoods, where GW is located, increased from about $480,000 in December 2018 to about $686,000 by December 2019, the report found. Real estate experts said Foggy Bottom’s uptick in property values is consistent with a national trend of rising urban housing costs.

Alyssa Ilaria | Graphics Editor

Donna Evers, Long and Foster’s managing broker, said people are moving to D.C. at a higher rate than the property is becoming available, which raises property values. D.C.’s population grew to about 706,000 last year, but growth has been slowing down over the past four years, WTOP reported last month.

“It seems to indicate that we have more money floating around loose in the city, and the people are able to buy more with the money they have,” Evers said.

Evers said Long and Foster compiles data from market research reports and real estate data to create monthly reports about housing prices in the area. An average of 30 units per month was sold in December 2019 compared with 35 per month in December 2018, according to the report.

Evers said D.C.’s market is the most successful she’s seen since she started working in the real estate industry. Evers has worked at Long and Foster for 35 years, according to her LinkedIn profile.

She added that Foggy Bottom’s hike in median home price is consistent with increases throughout the District.

The median price for single-family homes in San Francisco was $1.7 million at the end of 2019, about the same as 2018, according to San Francisco Curbed, a publication that reports on real estate. New York City’s median home price was about $650,000 at the end of 2019, nearly a 1 percent decrease from the year before, according to Zillow.

“It’s pretty thrilling to be involved in it right now because everybody has a very positive attitude toward being here,” she said.

Buyers were paying about 97 percent of the listing price in Foggy Bottom in December of both 2018 and 2019. Houses stayed on the market for an average of 38 days in December, compared with an average of 62 days in December 2018, and the number of newly listed homes in December 2019 is half the number recorded in December 2018, according to the report.

Real estate experts said Foggy Bottom’s upward trend in housing could indicate an influx of people in the area.

Jan deRoos, a professor of real estate at Cornell University, said houses are generally on the market for 16 to 90 days. He said rising housing prices in Foggy Bottom are a result of limited supply and higher demand for homes in D.C.

“It’s really, really hard to build in D.C. given the height restrictions,” deRoos said. “It’s hard to build densely, and that really limits the supply.”

Leah Brooks, the director of the Center for Washington Area Studies at GW, said rising housing costs are a trend in many large cities in which populations are rising but housing supply is stagnant. Harvard University published a study late last month revealing that rental housing costs have been on the rise nationwide, increasing about 37 percent over the past 20 years.

Brooks said Foggy Bottom and West End housing costs are rising because new, pricier housing units attract buyers with higher incomes than those living in existing units. She said factors like efficient transit and high walkability in Foggy Bottom contribute to the neighborhood’s high prices.

The Residences on the Avenue, an apartment building located above Whole Foods and a popular housing choice for students who do not live in residence halls, was constructed on campus in 2011, according to For Rent. Union Place apartments were built on K Street in 2018 and cost renters between about $3,000 and $5,000, according to the Union Place website.

“If you own, it’s great,” Brooks said. “If you’re renting, it stinks.”

She said short-term rentals, like Airbnb and HomeAway, could also drive up housing prices.

Short-term rentals have contributed to average inflation of 2.24 percent – a slight increase – on single-family homes, but inflation has exceeded 5 percent in areas like Foggy Bottom, according to research the University of Maryland published in December.

“Those kinds of rentals have probably slightly increased rental rates, particularly any part like this,” Brooks said. “It would be a very convenient place to get an Airbnb.”

Richard Green, the director and chair of the USC Lusk Center for Real Estate, said the District has a limited supply of housing because D.C. law restricts building height. Most buildings cannot be taller than the width of the street the building is located on, according to the Building Height Act Congress passed in 1910.

“This is a combination of a lack of supply and a desirable place to live because of the jobs, because of the amenities, because of transit, and so D.C. is very expensive,” Green said.

He said the hike in median home sale price likely indicates a hike in the number of townhouses or stand-alone homes instead of condos, or apartment-sized independently owned homes, which are smaller and less expensive.

Twenty-six condos were sold in Foggy Bottom and West End in December 2019 compared to 34 the previous year, according to the report. One attached home and no detached homes were sold in the area in December 2018, but four total detached and attached homes were sold in December 2019, according to the report.

Green said the benefit of rising housing costs for homeowners is wealth creation. For the younger population hoping to buy a home in the near future, the uptick in housing prices does not have much positive impact, he said.

“If you’re younger and just trying to get in the market, it sucks,” she said. “Very, very difficult to get in.”

Lia DeGroot contributed reporting.