For the first time in the past eight years, GW’s annual endowment stewardship report includes no information about new endowed funds.

GW reported 27 new enduring donations in fiscal year 2018 but did not provide any details about the new funds – a break from past years. Officials said the new format addresses donors’ “privacy concerns” and best reflects donor interest in the impact of their specific contributions instead of the overall management of the fund.

The most recent report details three cases of endowed funds supporting students and faculty but does not break down which endowed funds were created this year. One newly established fund – the Sanofi Professor of Prevention and Wellness – was included, detailing the creation of a public health professorship focusing on “increasing the nation’s focus on prevention and new treatment strategies in the management of chronic clinical conditions.”

The other pages of the report detail stories about the impact of financial aid and a professor’s lifelong wish to promote the study of international development and education. Neither of the funds mentioned were created in fiscal year 2018.

The 16-page report is about half the size of the report from fiscal year 2017. In previous reports, the name of the newly endowed funds and the beneficiaries were included.

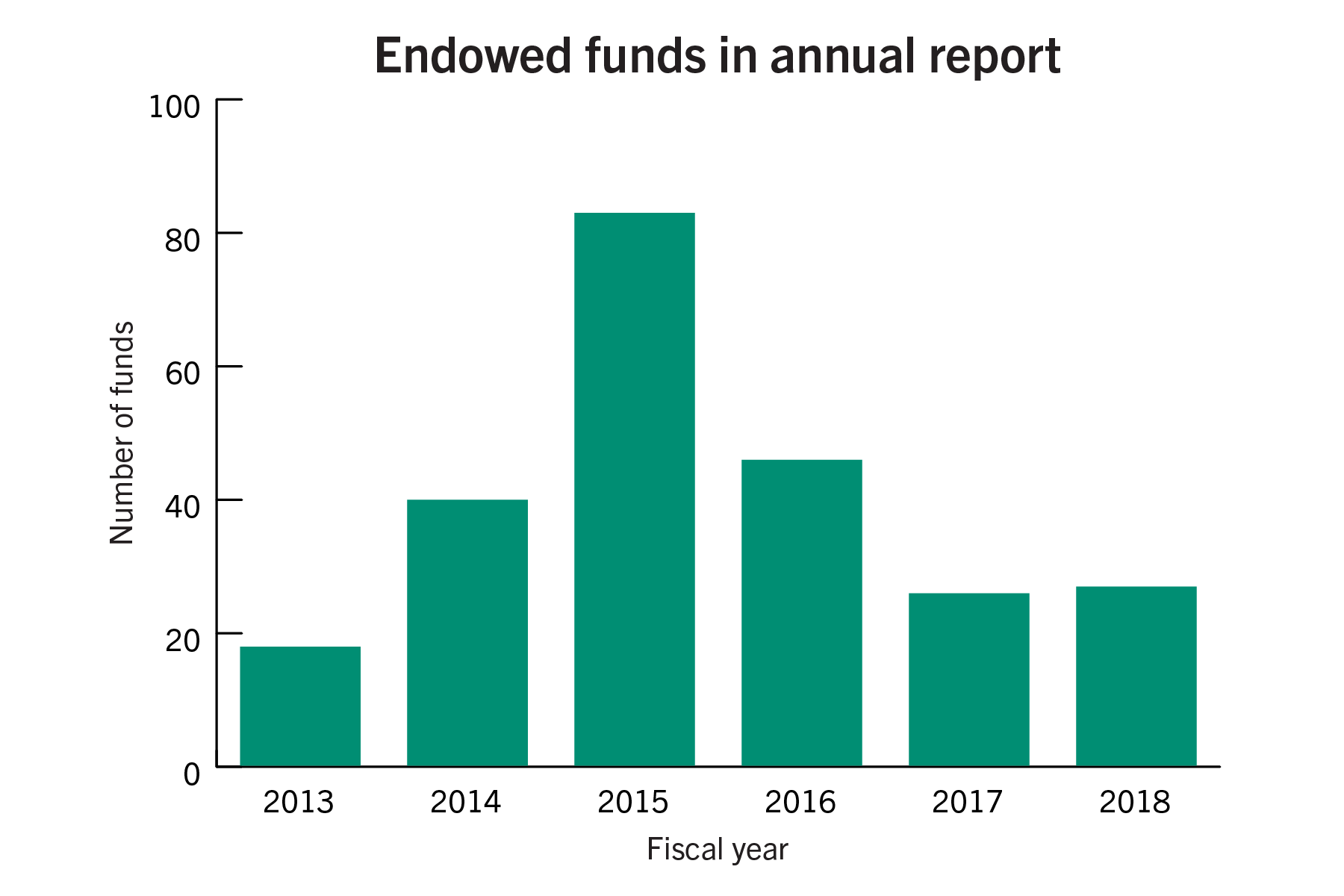

Endowed funds have been decreasing in recent years, falling from a peak 83 funds in 2015.

Donna Arbide, the vice president for development and alumni relations, said the shift in the style of the report stemmed from recipient feedback last year. She said donors reported the most interest in the performance and impact of the funds they supported or connected with.

“Based on that feedback, we chose to focus our effort on individual reporting and streamline the overall report,” she said.

Arbide added that the feedback received for the report has been positive since donors received it in December.

Emily Recko | Graphics Editor

Source: GW’s endowment stewardship report

She said information about endowment performance is included in the annual financial report, but additional information about the endowed funds was not provided this year because of donors’ “privacy concerns.” She said the description of the Sanofi Professor of Prevention and Wellness was included in the report with the donor’s permission.

Arbide added that the number of new endowed funds fluctuates, and the funds can take time to develop because of the large size of the minimum $100,000 gift.

She declined to describe the newly established funds for fiscal year 2018. She also declined to say if the new donation tracking system implemented in the fall would be used in the future to report endowed funds.

Fundraising experts said a less transparent report likely will not affect giving as long as donors still receive information about the individual impact of their gifts.

James Plourde, a vice-president at Illinois-based fundraising consulting firm Campbell & Company, said revealing specific information about the size of donors’ gifts and other details are something many non-profits try to prevent. He said for example, if a parent donated money to their child’s university, the parent may not want their child’s peers to know about a large gift.

“You don’t want to alienate a donor because you’ve shared a level of information that they are uncomfortable with,” he said.

He said most private universities do not issue general reports that discuss the impact of all endowed funds. None of GW’s private peer institutions have reports describing new endowed funds that are created.

He said that because donors are generally more interested in the impact of their own donations, they do not care much about the management of the fund. He said individual reports are more effective because they make the donor feel special.

“When you look at a strategy for building the endowments, it’s more important that donors feel like they are being well cared for,” he said.

He said withholding information that the University has traditionally provided likely will not have an impact on the ability to grow the endowment. When people want to give money to a cause, they do not shop around for schools that provide the best investment profile – but are more motivated by their connection to the institution, Plourde said.

Megan Sarber, the manager of donor relations at Manchester University in Indiana, said her university does not have a public release about donations. She said staff typically send out information about the impact of donors’ endowed funds because a more individual approach is not only easier for staff to manage but is more effective in engaging the donor.

Donors are more likely to care more about what their funds are accomplishing at a university than what other donations have done, she said. She added that endowed funds can require more stewardship than other kinds of donations because they typically warrant large gifts.

“We try to encourage endowed funds,” she said. “If you are making endowed funds, they last forever.”