It’s always awkward when your card gets declined at the cash register, but it could happen to any of us. Running out of money can be a bigger problem in college because everyone has a different financial situation. Where some students can fall back on parents, others are on their own. When money is tight in college, it can be a brutal wake-up call that you haven’t formally learned to make smart money decisions.

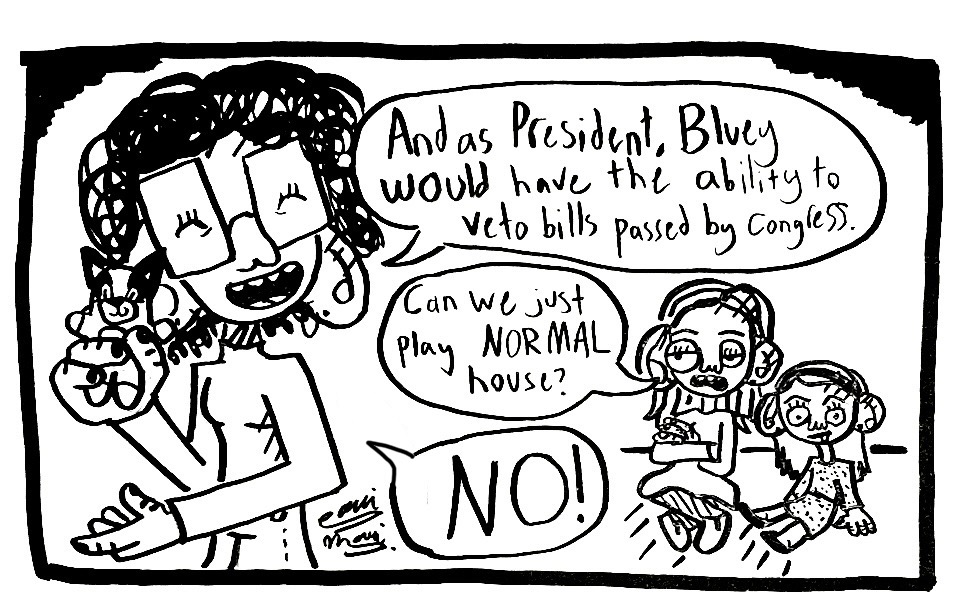

Cartoon by Jekko Syquia

When I had my own struggles budgeting money as a freshman this year, it made me realize that college is a perfect time to learn how to manage personal finances because I can’t depend on my family to help with my finances in the future. GW should recognize this opportunity and help students manage their future finances by teaching them how to budget early on through a course at Colonial Inauguration on managing day-to-day costs using GWorld. Students should take advantage of college as an opportunity to learn financial management skills that will remain important throughout their entire lives.

Before college, I was fortunate that I didn’t need to work to support myself. I had the food and clothing that I needed and wanted — and my parents made sure of that. But when I arrived for my first year of college – that changed. At GW, students are expected to budget starting at CI through their junior or senior years for food and other necessities using the GWorld card system. For many students, it’s the first time they are given a large sum of money and are expected to make it last the entire year. This can be difficult for students living in first-year residence halls, where access to kitchens is scarce and eating out daily is normal. This is also likely the first time students will be paying for their laundry costs rather than using free machines at home, and it could also be the first time a student takes out a credit card, opens a bank account or has to manage loans or bills. Not every student will stress about finances while at GW, and students with parents who can support them are lucky, but all of us will need to manage our personal finances after college, so it’s important to start early.

GW has a massive disparity between rich families and low-income families, which means students come in with different experiences with money. Whether students are in the top 1 percent of household incomes, like 14 percent of the student body, or in the bottom 60 percent, like 16.4 percent of the student body, learning to manage money responsibly is crucial.

In addition to differing family situations, some of us will never work a paid job in college, but other students have been working since they were legally allowed to. Despite these differences, what we all have in common is a finite amount of money that is available to us, which is why it is important that we spend time through classwork to learn how to manage funds so we don’t run out of money now or in the future.

GW doesn’t offer any introductory level courses in personal finance, but it is discussed in some courses. While personal finances are covered in sessions targeted toward first generation students, a course like this would be relevant to all students. This can be done by telling students, starting with freshmen, how much they’ll have per day to spend on food, reminding students of the costs of doing laundry and the toiletries that they might buy on GWorld and helping them create a plan to budget their GWorld for the year.

Making a budget for GWorld is one way to learn how to apply budgeting to real life. That way, students can implement methods of budgeting that they’ve learned at GW toward money management after graduation. While it’s tempting to spend money on clubs, alcohol or other entertainment options, especially while going to school in a city with lots to do, it’s vital that students are prepared for the real world, which also has attractive ways to spend money.

GW can help students learn the basics of budgeting by helping train incoming students on how to spend their GWorld wisely.

When students are repaying their loans, trying to lease an apartment or looking to move somewhere new, having budgeting experience is extremely useful. This is especially true for seniors living off campus that aren’t on the meal plan. Planning out your finances doesn’t mean you can’t enjoy yourself, but college is a great time to learn how to live within your means. If cooking at home instead of ordering takeout is what it takes to be able to go out on a Saturday night, then we should learn how to make those budgeting sacrifices now.

I regret many of my spending habits from my first year in college, but I am glad that I have time to learn how to better manage my money. While I am fortunate to have the support of my family, I don’t want to fall back on them due to my own mismanagement, and I do not want to depend on them after college. For all of us, including incoming freshmen and prospective students, the next few years present a chance to learn about managing money. GW can help students learn the basics of budgeting by helping train incoming students on how to spend their GWorld wisely, which will set students up for success with managing money later on.

Kiran Hoeffner-Shah, a freshman majoring in political science, is The Hatchet’s contributing opinions editor.