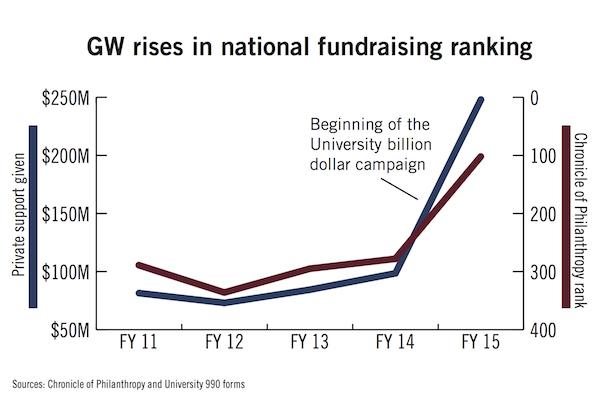

The University experienced a 151.8 percent increase in private support last year, moving up 176 spots on the Chronicle of Philanthropy’s list of the 400 top fundraising organizations.

GW had the highest percent change of any private university in the ranking and ranks 16th among private universities on the list. GW received nearly $250 million in private support in fiscal year 2015, the first time private support totaled more than $100 million since the report began collecting information in 1991, according to the Chronicle.

University officials confirmed that the acquisition of the Corcoran Gallery of Art and the Corcoran College of Art + Design was the largest single contribution to the University’s fundraising in fiscal year 2015.

The Chronicle of Philanthropy ranks the amount of revenue raised by 400 of the largest U.S. nonprofit organizations. The survey only includes money raised from individuals, corporations and private foundations, and does not include federal funding.

Aristide Collins, the vice president for development and alumni relations, said that fiscal year 2015 was a “robust” year for fundraising, with growth in endowment and annual giving in addition to assets gained through the Corcoran merger.

“We realized that this would be difficult to replicate in FY16, especially given the cyclical nature of philanthropy and development work,” Collins said in an email.

Collins said that although rankings like the Philanthropy 400 are “interesting,” fundraising results can fluctuate regardless of whether or not the University is in the midst of a fundraising campaign.

GW announced the public phase of a $1 billion fundraising campaign in June 2014, and officials said recently they plan to reach their goal by June 2017 – a year ahead of schedule. As of last week, more than 61,000 people had contributed more than $900 million to the campaign.

“Our focus continues to be on achieving our $1 billion campaign goal,” Collins said. “We are very actively engaging other individuals and organizations who can support GW’s mission with significant philanthropy, but it’s important to realize that the timing of a gift is ultimately up to the donor.”

Drew Lindsay, the senior editor of The Chronicle of Philanthropy, said universities’ revenues tend to fluctuate from year to year because they are based on large gifts, bequests and fundraising campaigns.

Before last year, GW had received about $80 million to $100 million in private support for the past six years.

Although the University’s largest gift, the $80 million that renamed the Milken Institute School of Public Health, was donated in fiscal year 2014, private support still increased the following year because of the acquisition of the Corcoran. Another large gift, a $2 million donation from Trustee Avram Tucker, was donated in October 2014, which is part of fiscal year 2015.

“Universities are what some people call ‘lumpy’ in giving from year-to-year,” Lindsay said. “They change a good bit.”

Lindsay said it’s common that a university’s revenue increases during a fundraising campaign, especially at the beginning of the campaign.

GW’s campaign has lost momentum since it began at the end of fiscal year 2014. Experts have said that fundraising campaigns tend to be more successful earlier in the campaign and decrease over time because fundraisers tap into big donors first and then rely on students and alumni later.

Katy George, the assistant director of annual giving and direct marketing at the University of Oregon, said when a university rises in the fundraising rankings, it can convince more donors to give. The University of Oregon also saw a large increase in giving the same year, gaining 112 percent from the year before.

“I think that when your school is on the up and up, when things are improving, people want to be part of that,” George said.

George said the number of people donating to higher education throughout the country is generally declining, so this kind of rise in the rankings is significant.

“Everyone is seeing their participation decrease pretty much,” George said. “To buck that trend is a huge deal.”