Updated: May 9, 2016 at 2:39 p.m.

The University will make an $80 million payment toward its overall debt this year, the highest yearly debt payment to date.

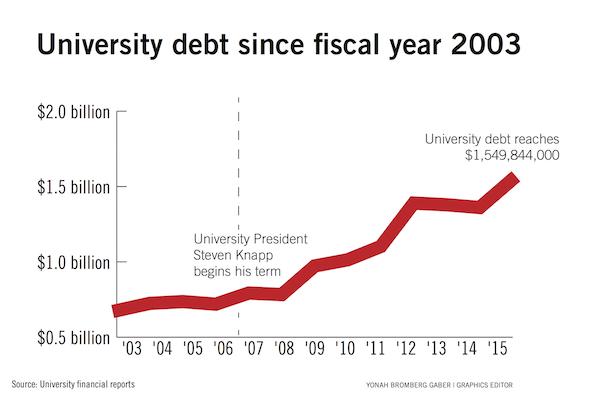

The University’s debt rose by about 14 percent this fiscal year, bringing the total to nearly $1.6 billion, which is roughly the same amount as the University’s endowment. Executive Vice President and Treasurer Lou Katz told the Faculty Senate Friday that revenue from properties and research subsidies is helping to pay down the deficit – the same properties that contributed to creating the debt.

GW’s total debt has steadily increased over the past eight years, but Katz said capital projects that bring in revenue, like parking garages and new academic buildings, have matched the debt increase.

“During this period of time, the value of our land and buildings at this institution increased almost a billion dollars, more than the amount of the debt,” Katz said. “It’s a very effective way to invest in ourselves with little risk to the institution.”

Katz said that over the next five years, the University will begin to pay off outstanding debts without investing in as many capital projects. He said GW had not previously paid off these debts because the interest rates were low, and the University’s loans are fixed-rate – meaning that the interest does not fluctuate for the time they have the loan. The University paid off a $200 million bond in full using on-hand cash in July 2015, according to Katz.

Katz said low interest rates will allow the University to extend the maturity of some debts that will come due in fiscal year 2019 from 10 to 30 years, which officials will have more time to pay off.

“We try to ladder what our maturities are so all debts are not coming due at the same time,” Katz said. “We believe this is a very secure debt strategy.”

He added that the return on investments, like the Science and Engineering Hall through federal subsidies from research grants, make large debt worth the risk but are not end-all solutions.

Officials have touted the $275 million building as a chance to improve GW’s federal research funding and attract top faculty, both of which in turn can bring in more money.

“Nobody is trying to say that research is going to be the nirvana that’s going to, from a financial basis, support the whole institution,” Katz said. “But it’s an important part of building the academic quality of the institution, and it’s doing its fair share.”

Donald Parsons, an economics professor, prepared his own report for the Faculty Senate last month. He said the debt has “mushroomed” in the past few years, after steadily increasing since fiscal year 2003.

Parsons said the debt has largely accumulated from the multimillion-dollar construction projects that officials have pursued and have been unable to finance. Officials have relied on rent from GW’s high-end commercial properties at The Avenue complex to cover about $250 million.

The Board of Trustees will approve the capital budget, which includes construction plans for the upcoming fiscal year, at a meeting next week.

“This Board of Trustees has an unusual predilection for running after glittery things,” Parsons said in an interview. “It’s like sending a person through Neiman Marcus. If they’ve maxed out their credit cards, you’d better pray that they’re going to make it to the other end without buying something more.”

The Board of Trustees has approached the debt with an “interest only” repayment policy, Parsons said. While Parsons said that paying off the total body of debt would be fiscally responsible, it would place a crushing burden on students.

Currently, debt service charges absorb about 12 percent of student tuition, but Parsons said that potential solutions to pay for the debt, like instituting a 20-year repayment plan, could potentially kick that up to nearly 20 percent.

The University is 75 percent reliant on student tuition for its operating budget.

Katz said in an email that about 25 percent of this fiscal year’s debt payments will be covered by tuition.

“It’s a question of how much we want future students to pay for what we’re doing now,” Parsons said. “That’s a judgement call.”

Both Moody’s and Standard & Poor’s – international crediting agencies – gave GW a “stable” outlook at the end of fiscal year 2015, meaning that the University is a low credit risk and is able to meet its obligations to the debts it has accumulated.

University leaders have attempted to cut costs through budget cuts, eliminating central administration positions and slashing faculty and staff benefits. Some faculty members said those actions give them pause about the University’s financial state.

“All of those facts would indicate that there’s a time of significant financial stringency,” said Arthur Wilmarth, a law professor.

Wilmarth said the debt can be largely blamed on construction projects.

“I think it’s fair to say that we’ve had an enormous period of building, we now find ourselves much deeper in debt,” Wilmarth said. “That’s certainly concerning.”