With two modifications made to national financial aid programs in recent weeks, GW officials are bracing for potentially major changes in the way federal dollars are awarded to students.

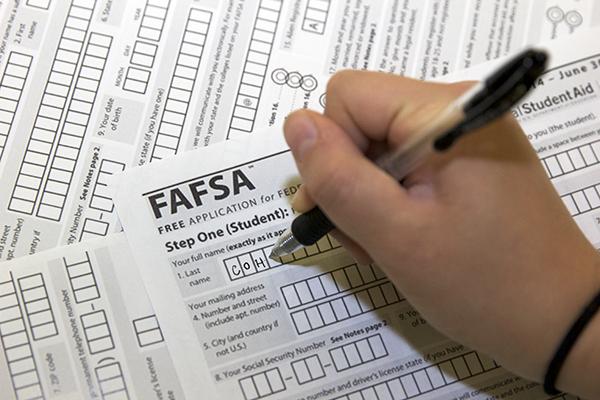

Last week, President Barack Obama announced plans to radically simplify, and eventually phase out, the Free Application for Federal Student Aid, which every college student must use to apply for federal, and sometimes state, aid each year. And with Congress allowing a national loan program to expire last week, experts say the shift toward simplicity could help the country’s neediest students apply for and receive aid.

Millions of eligible students, experts said, do not apply for financial aid because the FAFSA is too complex or they do not have access to the resources needed to complete the form’s 108 questions: like their parents’ tax returns and in-person guidance.

And leaders in Congress have pushed for an expiration of the Perkins Loan Program in an effort to reduce the number of federal loan programs and streamline the process of doling out dollars to students who need aid. About 2,000 GW students receive Perkins loans, University spokeswoman Maralee Csellar said.

Csellar said it was “unfortunate” that Congress allowed the Perkins program to expire.

“We hope that Congress will find a way to reauthorize the funding in the coming months,” she said. “In the meantime, we will work with our students who have been impacted by the cut in funding to find alternative ways to finance their education.”

About 1,700 schools participate in the Federal Perkins Loan Program, which full-time students must begin paying back nine months after graduation. Universities allocate Perkins funds for its neediest students who still need assistance after they max out on other need-based and merit-based aid. The amount is determined using federal guidelines that calculate how much a family would be able to contribute toward college costs.

At GW, the average Perkins award amount is $1,000 to $3,000 each year. Students who currently receive Perkins loans will apply for aid the same way they always have, through the FAFSA, and will be eligible for other loans after this year.

As for students coming to campus in August 2017, they will use tax information filed this April, which experts say will benefit lower-income students and help every applicant to be more informed even before they commit to one school. The FAFSA used to become available on Jan. 1, making it almost impossible for students to apply to school with financial aid in mind.

Associate Vice President for Financial Assistance Dan Small said GW would “continue to monitor updates and information from the Department of Education regarding changes they are making” to the FAFSA.

“Changes that help make the FAFSA easier to understand are very helpful for first-time college students and families as they determine how best to finance their college education,” he said. “We will continue to help all of our students and their families through the financial aid process.”

Though the push to streamline the financial aid process, and even phase-out the FAFSA, is an effort to make aid more accessible, experts said the process could become more complex if states decide to create their own financial aid forms instead of using federal information.

Mark Kantrowitz, the author of “Filing the FAFSA” and the publisher of a college financial advice website, said the 10-page form could still use simplifying, and that even when students can apply for aid in October instead of the normal spring deadline, the process will still “force low-income students to jump through hoops.”

Kantrowitz added that the applicants who need substantial aid often lose out the most. Low-income students, he said, often struggle with or give up on the the 10-page form for a variety of reasons, like being unfamiliar with the process because they are the first in their family to apply to college.

And he said that because they file earlier, students who complete FAFSAs in January can receive twice as much aid as students who submit the form in April.

Jennifer Delaney, an assistant professor in higher education policy at the University of Illinois at Urbana-Champaign, said there are a variety of reasons low-income students struggle with or do not complete the FAFSA.

To do so, students must have access to their parents’ taxes, which means students with divorced or estranged parents, as well as those whose parents do not file taxes, often grapple with the form, Delaney said. She said students could also be hampered by limited access to technology.

“If your access to a computer is a library or at school, it’s not enough time,” she said. “It’s hard to complete the FAFSA in one sitting.”

Students living in the U.S. without legal permission, who Delaney said often don’t realize that they can safely submit a FAFSA, and students whose first language is not English, also face additional barriers when it comes to filling out the form.

Brian Taylor, the director of Ivy Coach, a private college counseling service, said the move from January to October is a significant change because it will also paint a bigger picture of families’ finances, especially those who are not salaried.

“What if you work on commission? Let’s say you made $100,000 this year, but last year, you made $40,000,” he said. “You shouldn’t rely on just one year [of taxes]. It’s more of a picture of your earnings.”