Updated: Sept. 18, 2014 at 8:38 p.m.

GW traded in a more expensive employee health care plan to avoid paying nearly $1 million in additional taxes, and will now offer a cheaper plan to ease faculty concerns about rising costs.

That new plan is the first “high-deductible” plan the University has offered in recent history, and will likely help employees and families with typically lower health care costs cut down on how much they pay out-of-pocket, officials say.

The Affordable Care Act will start taxing organizations with more high-end plans by 2018, which is known as the “Cadillac tax.” That would have resulted in an almost $1 million tax burden, Vice President for Human Resources Sabrina Ellis said at a Faculty Senate meeting Friday.

“The goal is to take steps now, in anticipation of the excise tax, to use our benefit dollars wisely in keeping the plans affordable,” Ellis said.

The cheaper option comes after a year of faculty lobbying for less expensive health insurance payments. In the last two years, employee premiums grew by 21.5 percentage points. Employee premiums grew 3 percent this year.

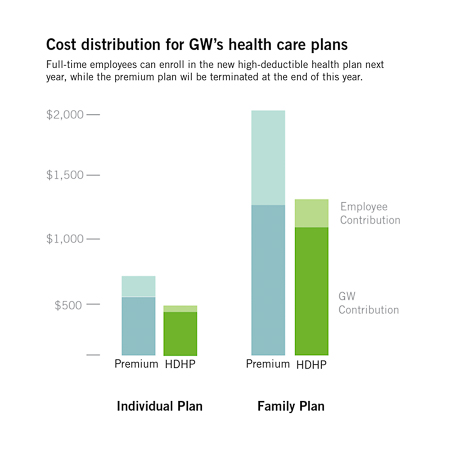

Families on the new high-deductible health plan will pay about $1,400 this year to get on the plan, which is a few hundred dollars cheaper than the other two options from which GW employees can choose. GW nixed its premium plan, which cost families more than $2,100 last year plus out-of-pocket payments.

The new option will provide faculty and staff with a larger deductible than GW’s other two options, giving employees and their families more flexibility, Ellis said.

After employees reach their deductible limit, insurance kicks in. A smaller deductible gives families with higher medical bills a better chance of having insurance cover more of their bills.

A larger deductible comes with a lower annual charge, but forces employees to pay out-of-pocket until they reach a higher limit. For younger employees in good health, that may be a bet they are willing to take.

“This is something that responds to requests that have come through to have a plan that offers greater flexibility,” Ellis said.

Many universities have started introducing high-deductible plans, which allow employees to set up a health spending account and contribute to the account directly from their paycheck each month, Ellis said.

Just 132 faculty members were enrolled on the premium plan and will be able to switch to other GW plans.

Still, faculty members said they are frustrated that the University didn’t do more to offset out-of-pocket costs.

Benjamin Hopkins, a history and international affairs professor and the secretary of the Faculty Association, said he doubted the new plan would lower costs for employees because they would have to pay high out-of-pocket costs to use it.

“The insurance doesn’t kick in until you’ve spent $1,500 on the deductible, all out of pocket. For the people who are least able to afford it, if you don’t use it, it’s fine,” Hopkins said. “It’s going to be very difficult on these people.”

The new plan doesn’t stop GW’s trend of shifting costs onto employees, he said, adding that administrators failed to respond to faculty requests to increase their contribution to health insurance costs.

Hopkins was one of the faculty members to help create the Faculty Association last spring. The group, which claimed the Faculty Senate was not doing enough to raise concerns about health care costs, came together after more than 160 faculty members signed a petition asking GW to increase its contributions to insurance plans.

Hopkins said faculty do not believe GW is keeping up with how much peer institutions are putting toward their plans.

A document Ellis shared with members of the Benefits Advisory Committee showed that GW contributed fewer cents to fringe benefits for every dollar paid for an employee’s salary than nearly all of its competitor schools. GW contributed 25 cents per every dollar of a salary to benefits packages, while neighboring Georgetown University contributed 35 cents per dollar and American University offered 26.5 cents per dollar of their respective employees’ salaries.

Jon Gruber, a Massachusetts Institute of Technology professor of economics who focuses on health care, said slowing increases to health insurance costs puts the University back in line with the national trends, after a few years of being an outlier. Costs nationwide have grown at a slower rate since the recession, he added.

A report released this week by the Kaiser Family Foundation showed that premiums for employer-sponsored family health plans increased about 3 percent nationally, roughly the same as GW’s increase.

Still, that slower growth has translated into higher deductibles for plans covered by their employers. The report found the average deductible has risen 47 percent since 2009.

“The deductibles for workers have crept higher over time, topping $1,200 on average this year,” said Gary Claxton, the study’s lead author and a vice president at the Kaiser Foundation.

Robert Harrington, chair of the Appointment, Salary and Promotion Policies Committee of the Faculty Senate, said the committees that help decide benefits packages had met with Ellis to discuss the policies before the meeting.

Although the price for some plans increased more than 3 percent, he said faculty who use their plans likely will not see a significant change.

“The issue really is that a number of other costs have not been increased at all, in terms of prices of deductibles of various plans. And so overall, therefore, if you use the plan enough, you probably could say that the overall increase is about 3 percent,” he said.

This post was updated to reflect the following corrections:

The Hatchet incorrectly reported that employee out-of-pocket costs grew by 30.5 percentage points between 2012 and 2014. Employee premiums grew by 21.5 percentage points in the last two years. The Hatchet also incorrectly reported that out-of-pocket costs for employees rose about 3 percent this year. Employee premiums grew 3 percent this year. We regret these errors.