The University depended on tuition for about 62 percent of revenue last fiscal year, an increase over the past four years that heightens the urgency to bolster endowment, research and fundraising.

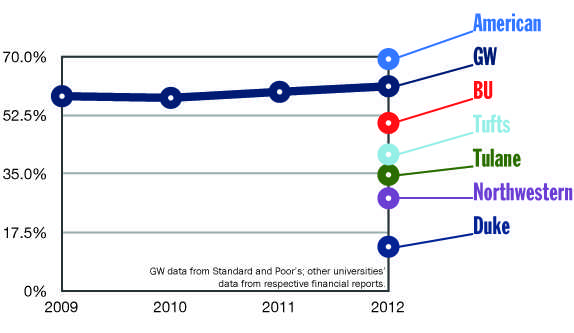

GW’s reliance on tuition revenue is second-highest among the 14 schools GW calls its peers, according to a Hatchet analysis. Administrators will have little progress to report to accreditors June 1, six years after they cited this high dependency as the greatest restriction to growth.

Executive Vice President and Treasurer Lou Katz said because significantly growing the University’s other financial resources will take decades, he expected the lag time in weaning GW off tuition dependence.

“Our tuition dependency today isn’t materially different than what it was five years ago. Or, in fact, 10 years ago. And the truth of the matter is, unless we get extremely fortunate, our tuition dependency is not gonna move significantly for many, many, many years,” he said.

The University pulled in nearly $570 million in net student tuition and fees, while counting about $1.01 million overall last fiscal year. Standard & Poor’s reported GW’s tuition dependency as 62 percent in its January report, taking gross tuition revenue as a percentage of adjusted operating revenue.

That dependency, coupled with a relatively small $1.3 billion endowment, has perpetuated high tuition and high debt.

It was a factor in GW’s price tag crossing $50,000 in 2008 to become the most expensive college in the nation, though it has since dropped off that list. GW’s $1.4 billion debt slightly tops its endowment.

Top universities like Duke also pull in big money from their research enterprises and investment returns from larger endowments – financial areas GW is playing catch-up to bolster.

Katz stressed a holistic approach, as the University has centered spending on new faculty, research buildings and financial aid in order to improve. The University has also brought in more tuition revenue in recent years by tapping more graduate, online and international students for funds.

“We’re just aiming in the right direction [to lower tuition dependency], but at the same time improving the quality of the institution,” Katz said.

David Jacobson, a communications strategist for Moody’s, said the credit rating agency has a negative outlook of the entire higher education sector because universities have come to rely too heavily on tuition revenue in the face of shrinking endowments.

“Traditionally, the ways universities have brought in more revenue is to continue to increase tuition, and there is now quite a bit of pushback on what private universities can charge for some of this,” he said. “They need to take several steps to get incoming funds.”

GW is also more tuition-dependent than most peer schools, as universities like Boston and Tufts relied on tuition for about 50 and 41 percent of their total revenue, respectively.

The University is above par, however, when compared to private universities with top credit ratings, and not just its peer schools. Private universities that earned an “A” rating from S&P averaged 70 percent tuition dependence.

Historically, GW’s high tuition dependency partly stemmed from lackluster fundraising. As late as fiscal year 2008, the University ranked among the bottom third of universities on a Chronicle of Higher Education list breaking down schools’ operating budgets, raising only $58.6 million for the year.

Since then, the University has invested in its fundraising arm by bulking up staff and increasing its number of alumni events. Last fiscal year, it pulled in $120 million, shattering records for the fifth year in a row.

Mike Morsberger, vice president of development and alumni relations, said his office is looking for untapped donors to boost fundraising efforts as it lays the groundwork for a comprehensive fundraising campaign for the coming years, lowering GW’s tuition reliance.

“There’s a potential opportunity we have not fully realized to get people giving and involved. That’s why I came here. The upside is huge,” he said. “They’re counting on philanthropy.”

–Chloé Sorvino contributed to this report