Deal or no deal? The answer has big ramifications for GW.

The fallout from the fiscal cliff could harm the University’s research and fundraising efforts as lawmakers stare down massive spending cuts and tax reform.

As the hours tick by before the Jan. 1 fiscal cliff deadline – and with a deal only starting to emerge Monday – the impact on GW could be twofold.

First, if the $1.2 trillion in automatic spending cuts kick in, the federal agencies that dole out research contracts to professors would lose billions of dollars.

University researchers have voiced big concerns over the 8.2 percent hole that the automatic spending cuts would puncture in federal agencies’ budgets if Congress can’t make a deal.

The effects would be real for researchers, with fewer grants up for grabs and less money for young professors, as well as a bump in the road for the University, which has aggressively tried to build itself up as a major research institution.

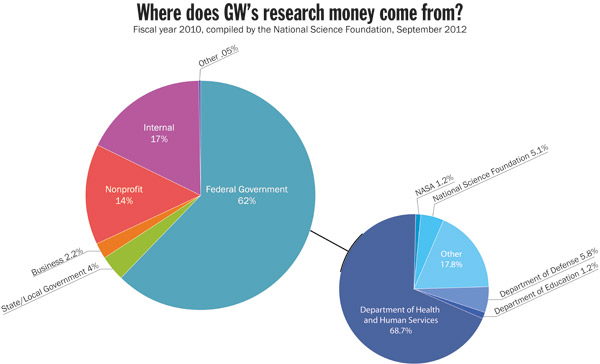

GW researchers earned $122 million, or 62 percent of their total research dollars, from federal research agencies in fiscal year 2010.

The deep cuts would reach across the board and slice the budgets of researchers’ most significant benefactors like the National Institutes of Health and the National Science Foundation.

If the “meat axe” to the federal budget, as one lawmaker called it, hammers down, professors would likely see more money for research coming out of GW’s pockets. As federal research dollars have remained stagnant for years, the University has looked to fill the void lately, tripling the amount of internal research funding between 2008 and 2010.

Through a spokesperson, GW’s Vice President for Research Leo Chalupa did not return a request for comment on how his office would try to offset potential cuts. In past interviews, administrators have shed some concern on the situation, but remained confident that the cuts would not go through.

People who rely on unemployment benefits would endure the harshest blow from the automatic cuts, as that program will immediately run out. But lawmakers could reach a budget deal in the coming weeks to still stave off the brunt of the cuts.

“There’s nothing that’ll happen January 2 that couldn’t be reversed quickly. It’s not like we’re going to go into an abyss,” he said.

Second, lawmakers may negotiate changes to the tax code by lowering deductions for charitable giving , affecting GW’s philanthropy operations.

To add more revenue to the federal government’s coffers, Democrats have proposed lowering the tax break for charitable giving. In past negotiations, President Barack Obama has pitched lowering the deduction for the wealthiest Americans from 35 percent to 28 percent.

If lawmakers approve that change and raise marginal tax rates for the wealthy overall, charitable giving would fall by 2.4 percent, according to the Center on Philanthropy at Indiana University.

“It’s important to acknowledge that people don’t give because of tax deductions,” said Patrick Rooney, executive director of the Center on Philanthropy. “But we know changes in tax policies do affect how people give and affect large-end donors who give mega gifts to colleges, universities and hospitals.”

Mike Morsberger, GW’s vice president of development and alumni relations, said his office is business-as-usual as Congress contemplates changes to the tax code.

“Donors give to GW because they know and love the institution and what we do – tax advantages are only one of many factors affecting donor’s decision,” he said in an email. “Some donors may care about it more than others, but very seldom would it be the main reason to make a gift.”

The University has expanded fundraising efforts in recent years to fulfill some of its big ambitions for construction, financial aid and academic programs, like a $275 million Science and Engineering Hall. GW had its most successful fundraising year last year.

Democrats also want to raise the estate tax, which could actually spur more estate gifts to universities because the deduction for charitable giving would remain in place. GW pulled in 56 percent more gifts left in donors’ wills last year.

This post was updated Dec. 31, 2012 to clarify that the fiscal cliff deadline is Jan. 1 but automatic spending cuts go into effect on Jan. 2 because federal offices are closed New Year’s Day.